Clear information on how private companies are performing can be challenging to find. At ICG Enterprise Trust we have, in recent years, enhanced our disclosure around the performance of our portfolio companies. Therefore, we are pleased to be able to provide this excerpt from the 13th bi-annual edition of the ICG Private Company Trends report. Clients of our manager, ICG, receive the full report and can explore its in-depth view of the key fundamental trends that the global alternative asset manager is seeing across this segment of the market and an assessment of the outlook for 2025.

Bucking the trend

Private company EBITDA growth in Europe and the UK has bucked the trend of relatively weak European headline economic growth in 2024. Sector mix and company selection have played a key role in the continued outperformance, and in the view of ICG, should continue to hold European and UK private companies in good stead going forward.

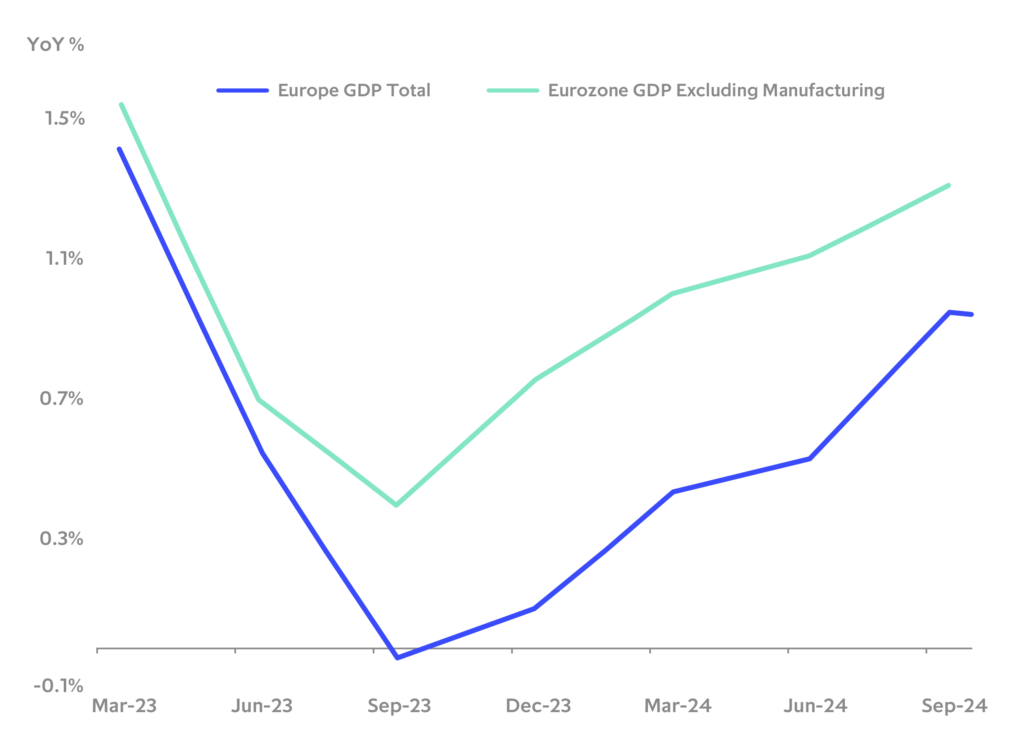

Although Europe and UK headline GDP growth rates were lacklustre in 2024, the headline growth rates mask investor-critical information at a sector and sub-sector level. As the chart below illustrates, outside of the manufacturing sector, growth across Europe has been much stronger than the headline GDP numbers (and press headlines!) would indicate.

Eurozone services sector growth stronger than headlines indicate

Strength in services

With services making up around 85% of Europe and UK GDP and most private markets investment focused in the services sector, it is not a surprise that private companies tracked by the ICG Private Company Database have performed well.

Sector selection has played an important role in sustaining healthy growth through the Covid and energy shocks of the past few years. Sectors with strong secular themes such as software & services; sub-sectors of the healthcare sector such as healthcare services; infrastructure and services companies involved in the green transition; logistics; as well as a range of internationally competitive commercial and professional services businesses; education services; consumer staples and parts of the consumer discretionary sector have continued to see strong growth.

The sectors that have suffered most strongly have been energy- intensive industry (chemicals and autos in particular) and segments of the manufacturing sector tied to China demand and susceptible to supply chain disruptions. The full report illustrates in pie charts how these are areas which most private markets investors have limited exposure.

Summary of key findings

A short roundup of the report’s conclusions:

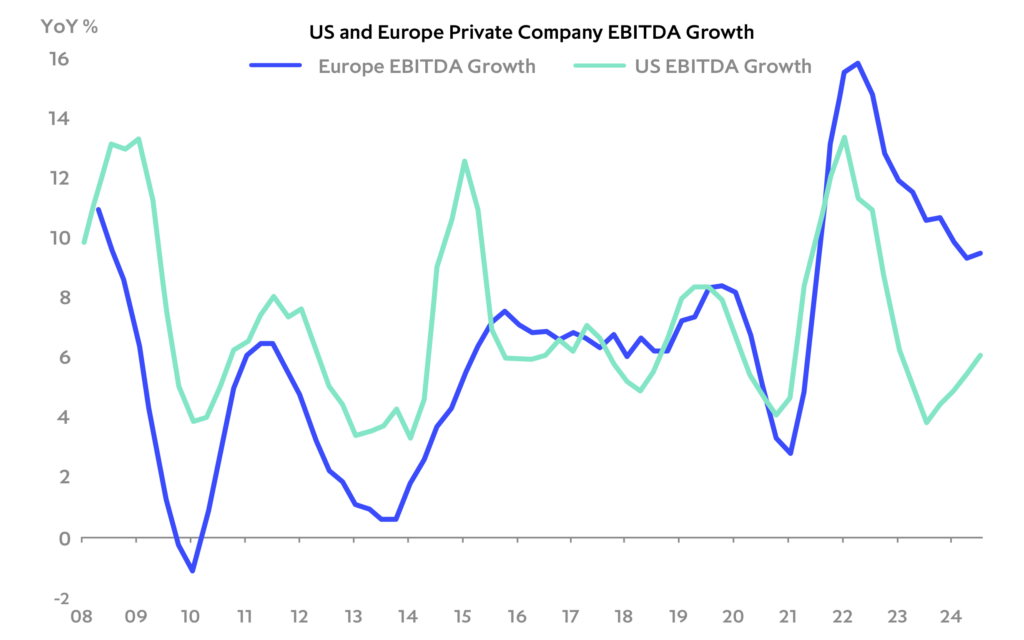

- Private companies in Europe, the UK and the US performed strongly through the first nine months of 2024, according to data tracked by the proprietary ICG Private Company Database. The database tracks key financial metrics of around 500 US and European private companies on a quarterly basis, providing unique insights into the structural fundamentals of companies that make up the private markets universe.

- US private companies also performed well in the first nine months of 2024.

- Debt sustainability measures have held up well, with strong EBITDA growth helping to offset continued high interest rates.

- Despite substantial geopolitical uncertainty and potential policy risks, private companies tracked by ICG’s Private Company Database appear to be well-positioned for the year ahead.

Resilient private company EBITDA growth

Past performance is not a reliable indicator of future results. Investing in private markets involves substantial risks, including the risk of capital loss. The value of investments can up as well as down.

Back

Back